Robots-as-a-Service:

Robots-as-a-Service:

This article outlines how to successfully build a Robotic Service Provider organization, based on a Robots-as-a-Service (RaaS) business model.

Introduction

The business model for buying and selling industrial equipment is rapidly evolving. The convergence of cloud-based solutions for IT infrastructure and the evolution of innovative enterprise software licensing is now spilling over to manufacturing infrastructure and supply chains. Companies such as Locus Robotics, InVia Robotics, Savioke, Cobalt Robotics and Knightscope have demonstrated an affinity for solutions with business models which enable customers to pay-as-they-go in a subscription or hourly rate-based financing model. Software-as-a-Service (SaaS) has given birth to the new Robots-as-a-Service (RaaS) business model, and this concept is beginning to impact how robotics companies must structure their organization and product design process.

Executive Summary

This article introduces the basic product strategy and business model requirements necessary to develop and deliver robotic-based solutions as a service or subscription model. If you are a manufacturer of Autonomous Mobile Robot (AMR) solutions, this article will outline how the product strategy of subscription-based pricing and service delivery is different from the classic capital equipment sales and support model.

If you are an executive or product leader considering the implementation of a subscription-based product strategy or you are in the process of creating a new Robotic Service Provider (RSP), then this document will provide you with the guidance to understand and mitigate many of the issues surrounding the successful implementation of your new solution and corporate strategy. The robotics business has historically operated on a “classic” capital equipment product design and sales business model.

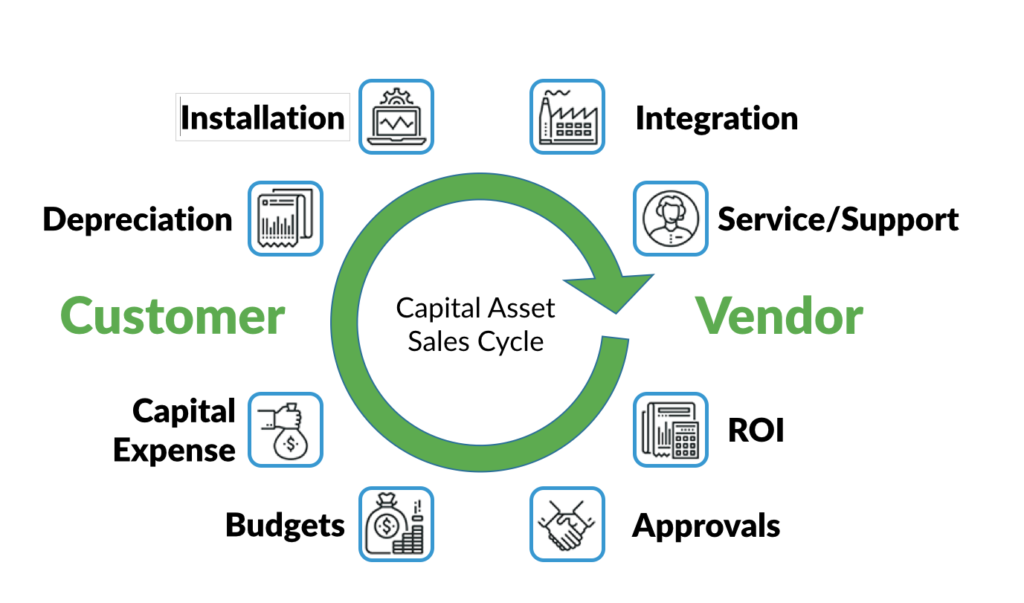

Under this existing sales strategy, new products are developed to meet a market need and then marketed and sold to target customers as a capital asset purchase. The customer owns the equipment and is responsible for the maintenance and repair of the equipment over its useful life. At the end of the product life, the customer is responsible for the disposal of obsolete equipment. RaaS changes all of that.

“Robotic Service Providers are emerging as a the next generation of automation providers. Robots-as-a-Service is core to the business model of RSPs.”

Mike Oitzman – Founder, The Mobile Robot Guide

The Capital Asset Approval Cycle

The annual nature of a capital asset purchasing cycle imposes a sales cycle which can vary from anywhere from 3 to 18 months. This cycle varies depending on when the equipment sales team is able to jump into the purchasing organizations buying cycle. For the customer, building the business case for expensive, fixed asset, capital equipment often requires many layers of management approval. For an autonomous mobile robot supplier, the multi-channel nature of the sales process makes it extremely difficult to control the sales process and to maintain an accurate sales funnel. The capital equipment purchasing cycle isn’t optimal for either the supplier or the customer.

Customers pay for what they consume

A subscription model allows the buyer to scale up and scale down their consumption as their needs change. The buyer is purchasing a complete service rather than a good, in the same way that you might sell your lawn mower and outsource your lawn care: ordering twice-weekly service during peak season and canceling the service in the dead of winter. With RaaS, you are changing your business from “selling lawn mowers” to “selling lawn care”. Target applications for robotics-as-a-service will have similar hallmarks to the lawn care example, where the consumer can leverage additional robot usage during peak periods and idle or halt service during slow periods, with a variable rate of payment based on consumption.

The implications of a Robots-as-a-Service model have a deep impact on the financing for your business as well as your business accounting practices. RaaS changes the expectations of the customer and the fundamental ways in which they pay for and engage your services as a supplier. RaaS contracts needs to be accounted for as a service contract rather than a product sale. As a result, it can be extremely difficult for a young robot company to offer solutions both as a capital purchase and as a service.

RaaS Advantages for the Vendor:

Robots as a Service is emerging as a dominant method for financing automation projects. Here’s a list of the Pros and Cons for RaaS:

Pros

- Simplified return on investment (ROI) criteria.

- Shortened sales cycle.

- More intimate customer relationship = longer lifetime value.

- Predictable revenue (customer ARR)

- Ability to redeploy used equipment for longer asset utilization.

- You can be more agile in your development and product roadmap since you have customer usage data to support roadmap decisions.

Cons

- Difficult to educate investors about the capital requirements for a RaaS business model.

- Larger upfront capital investment is required to build a production robot fleet.

- You need to carry the assets on your books through depreciation.

- Some customers will balk at allowing remote access through their network.

Conclusion:

For the right automation applications, Robots-as-a-Service can be the simplest and fastest way to procure and deploy an autonomous mobile robot.

A new customer interaction model

As you evaluate the viability of RaaS for your business, the first step is to understand the organizational changes that a RaaS business model imposes on your organization. A RaaS business model offers advantages across the product design and implementation cycle, but it also requires a wholesale change in the financial investment necessary to fund a fleet of robots in the field. The implementation of a RaaS business model will consume more capital over the long term since the fleet of robots is owned by you the supplier, not the customer.

You will need to evaluate all of the financing and accounting changes that come with building and maintaining a working fleet of robotic equipment in the field. Since 2016, the venture capital community has educated itself about the differences in a RaaS robot supplier over a classic capital equipment robot supplier. Unfortunately, this hasn’t resulted (yet) in a “land rush” to invest in RaaS-based robotic solution providers.A simple solution to the financing issue might appear to be the use of a leasing agent as a financing intermediary with the customer.

However, a leasing contract alone is not RaaS and customers would be right to be wary of a supplier attempting to sell a leasing option disguised as RaaS solution. RaaS is accelerating the product innovation cycle and it requires that equipment suppliers provide a level of service which hasn’t existed in the market prior.

Market considerations for a RaaS business

There are specific market needs that must exist for a RaaS-based solution to be viable. Let’s look at a few of these.

The automation problem must be scalable

The problem to be solved through automation must be measurable with some key performance indicators (KPI). As the saying goes, “if you can’t measure it, you can’t manage it”, therefore there must be some immutable way to measure the KPI’s and consumption rate for the solution This measurement must in turn be effectively reported on and invoiced by the supplier. You will need to include features in your solution which enable you to measure and track system performance. Next, you need to make sure that you can get access to this information, which will be stored within the system deployed onsite at your customers facility. This capability needs to be in version 1.0 of your solution, as without it, you don’t have a business.

Operating expenses

The second requirement of the market is that the operation in question must be funded by an operating expense (OpEx) since the solution won’t be capitalized. OpEx dollars are typically discretionary for the purchasing manager, without the need to seek high-level approval. Executive approvals can be a deal killer in a capital expenditure selling process. The result, however, can be a simplified (and shorter) selling cycle. This benefits both parties.

Production guarantee

Two of the key things that every production manager cares about are: production throughput and production quality. Automation tools leveraged in the manufacturing process are driven by this requirement. Production spikes are inevitable, and enabling the production team to smooth production spikes will be advantageous for the supplier. In service robotic markets, the solution is more task or demand driven in its application as opposed to the process-centric needs of manufacturing.

In this situation, the robot may spend time idle, as it waits for the next request or job to come in. Likewise, in a service application, there are likely to be periods of overconsumption or periods in which there are more tasks to do, than robots to do it. Helping customers solve consumption bottlenecks in the application will be key to providing a viable “whole” solution.

A fundamental shift in product design

Now that we understand the economic differences between a service provider, a service solution and the classic hardware business model, we need to outline some of the product development process differences in a RaaS business model. Fundamentally, the design of a product to be implemented as a capital asset will include the design and selection of components that optimize for the lowest possible bill of materials (BOM) cost and maximize the product sales price, thus maximizing the gross margin for the product at the product sale. Historically, hardware product organizations are incentivized to optimize gross margins.

Obsolescence and supportability are often two additional design variables that the design team considers in the tradeoffs with system component selection. In fact, many design organizations don’t evaluate factors such as Mean-Time-To-repair (MTTR) and Mean-Time-Between-Repair (MTBR) until a product has been in the field for a period of time and real usage data is available. For a service-based product, these factors must be optimized in the design choices as field support costs fall directly back to the solution provider. The net result is that with a RaaS solution, the fundamental design goals are different: you want to maximize product life and minimize support costs in the field.

The key here is the solution provider carries the burden for maintaining the equipment in operational condition in order to meet the contractual service level agreements (SLA). Design for supportability is key. Remote diagnostics are one way to reduce the operating costs of the solution in production and help to make any onsite support trips as effective as possible.

Remote access and monitoring

Remote monitoring and remote system access are additional system requirements that are crucial to the success of your RaaS solution. Remote monitoring means that you will know when a robot has broken down, or when a robot is in need of maintenance. If a robot breaks down, your support team will be able to remotely troubleshoot the system and ideally get it back into production within your Service Level Agreement (SLA).

SLA’s are standard practice for enterprise Software-as-a-Service (SaaS) solutions and have set the benchmark by which RaaS must operate.Security of your remote monitoring system is paramount if you want to get past the system security validation checks of your client’s IT department. The good news is that cloud-based application security is well defined now. However, you must hire the right resources to help you build and deploy a secure computing environment for your RaaS solution. An insecure solution will be a roadblock to successful deployments.

Organizational changes required

Creating a RaaS-based solution, means that you are creating a service organization, not a product-based organization. A service-based business requires a different organizational design from a product company. There are six key organizational areas that will be new or significantly different in a service provider:

Customer Success Manager (CSM) role

Equal parts sales, support, consulting and training, the CSM team is a unique and critical element of the RaaS organizational infrastructure. The CSM is essentially the customer champion and is responsible for maintaining a happy customer while growing the annual revenue from each customer over time. CSMs should be a commissioned role where CSM bonuses can be tied to upselling and retaining customers.

Customer support team

The customer is paying for the solution to function, thus the support team becomes a critical resource in the company to ensure 24/7/365 customer satisfaction and that Service Level Agreements (SLA) are fulfilled. The customer support team will grow with your installed base.

Network Operations Center (NOC)

Remote support and monitoring of production equipment require the addition of a 24/7 network operations center to monitor all of the equipment in the field. Likewise, you must have remote network access to the production equipment within your customers’ facility. While the infrastructure for the NOC may be in the cloud, the care and feeding of all of the security and infrastructure tools fall back to your organization’s resources. Some RaaS companies call this their “Robot Operations Center” and it is essentially the command central for monitoring all of the deployed robots in the field.

Marketing team

The role of marketing has to include both finding new customers and nurturing your installed base to up-sell options that increase recurring revenue. The good news is that your installed base is a captive and vocal resource to help guide the evolution of your solution over time. Marketing needs to work closely with the CSM team to interact with the installed base.

Sales team

Unlike product sales organizations, in a service organization, the CSM role is typically responsible for the customer relationship post sale and that includes contract renewals and up-selling services. This means that your sales team has to be made up of “hunters”, responsible only for landing new customers. The upside to RaaS is that the sales cycle is an operating expense (OpEx) sales process. OpEx sales cycles are typically shorter than CapEx sales cycles. This can be a huge competitive advantage over competitors selling equipment as a capital equipment sale. Sales team quotas should be focused on finding and closing new business. The post-sale, account management relationship transfers to the CSM after the sale.

Accounting & financial practices

With a RaaS model, the accounting team must manage revenue accounting and contracts in the same way as a services organization. Revenue amortizes over the life of the contract, rather than being booked when the equipment ships, as in a capital equipment sale. Tracking start and end dates for service delivery and new service options are key. On the positive side, budgeting and forecasting visibility improve with the stability of annual recurring revenue from the installed base.

Use cases

Let’s look at several of the market leaders in the autonomous mobile robot market. The companies highlighted below have all successfully launched a RaaS-based mobile robot solution to market. Each of these companies has developed a market-specific solution and is delivering it primarily with a RaaS business model.

Locus Robotics

Locus Robotics’ autonomous mobile robots. | Credit: Locus Robotics

Locus Robotics is one of the largest and most successful Robots as a Service providers. The company has developed a warehouse persons-to-goods solution that is quick to deploy and easy to use. Warehouse workers can learn how to interact with LocusBots in a matter of minutes.

The solution is inherently scalable, and that’s one of the hallmarks of a good RaaS solution. More robots can quickly be added to the warehouse to help during high season or for specific periods of the day/week. Locus Robotics monitors the performance the robots 24/7 and can remotely recover a robot that’s down or initiate a service call with a field service agent, all without customer involvement.

Aethon

Aethon was one of the early innovators with a RaaS business model. Aethon launched their autonomous mobile robots into hospitals. The robots deliver pharmacy orders from the central pharmacy, out to the nursing stations. Aethon was the first company to launch with remote monitoring and remote support of their systems. Aethon successfully sold the solution by eliminating the need to train anyone onsite to become a robot expert. Through their remote operation center, Aethon support engineers are alerted when a robot stops operating and they are able to remotely recover the system and put it back into operation, often without the client ever knowing that the robot stopped in the first place.

Relay Robotics (was Savioke Robotics)

The Savioke Relay+ features three new configurations and a mechanical elevator interface. | Image credit: Savioke

Relay Robotics is currently one of the most successful and best examples of a service robotics company that has been optimized from the onset for delivering RaaS. The Relay solution targets the room service deliveries in the hotel hospitality market. The business model and financial justification for the Relay solution are simple, rather than replacing the human labor in the hospitality space, Relay sells its solution on labor augmentation and productivity, essentially making the case for improving customer service over replacing human-based jobs.

Relay designed its robotic butler from the onset to be deployed as a service, charging a set rate for the use of its solution. Component decisions in the platform design were selected not to bring the lowest cost bill of materials to market, but rather to optimize the robustness and field performance of the system to deliver the longest MTBR and reduce the costs of running the robots over the lifetime of the system. The investment in higher quality components will be returned over the life of the robotic system.

KnightScope Robotics

Knightscope’s security robots can be used in government facilities, hosptials, schools, airports and more.

KnightScope Robotics was the first security robot provider to offer an autonomous mobile robot security solution as a service. KnightScope recognized that the security market is easy to characterize by an hourly wage and they brought their solution to market at a competitive hourly rate.

Customers pay for the solution as they would pay a human security officer. KnightScope remotely monitors the robots in operation and they are able to help the onsite client security team to manage any emergency situation which may arise. The KnightScope robots serve as an easy-to-justify extension of a client’s human security team, especially on graveyard shifts, which are difficult to fill with human workers. KnightScope has designed their solution to operate with the public finding duties within malls, parking lots and public areas.

Cobalt Robotics

Cobalt Robotics is a new challenger in the robot security space. Like KnightScope, they are offering their solution as an extension of the human security team. However, Cobalt is primarily focusing on corporate campus security, offering a solution that also includes additional onboard sensors to check environmental conditions (temperature, humidity, gases) as well as facial recognition and badge scanning technology to help evaluate and control access to controlled areas of a facility.

inVia Robotics

InVia robots in the Rakutan warehouse (courtesy of InVia)

inVia Robotics has developed a goods-to-person solution that helps automate existing warehouses by picking totes, boxes and cartons from warehouse shelves and delivering products to pack-out stations for order fulfillment. From its inception, inVia has been structured as a RaaS company. Their biggest business innovation is their capability to help customers scale up and scale down throughput by shipping additional robots to customer facilities as needed. Unlike many of their competitors who started as product companies, and who are trying to pivot to RaaS, inVia is 100% committed to RaaS as their business model.

Updated: October 5, 2022